Discovering the Best Dividend Stocks Made Easier Than You Think...

2024-03-05

Last update on 2024-03-05

An 11-Step Process Simplified to a Single Click

Investing in dividend stocks can provide a steady stream of income and be a valuable addition to any investment portfolio. However, with countless stocks available in the market, it can be challenging to identify the best ones that align with your investment goals. Fortunately, there's a tool that not only simplifies the process but also provides detailed explainability, making the assessment of dividend stocks transparent and reasonable. On marketstorylabs.com, we are simplifying the analysis of dividend stocks to just a single click.

In this blog post, we will unveil an eleven-step process that is utilized by us enabling you to effortlessly analyze dividend stocks and find the most promising opportunities.

The Approach - Assessing 5K Public Companies worldwide against 11 Key Criteria

At marketstorylabs.com, we believe in providing you with a data-driven approach to assess dividend stocks. We have tested a vast selection of more than 5K public companies worldwide against our carefully curated set of 11 key criteria. This rigorous evaluation is designed to provide a clear understanding of the dividend performance of every single stock compared to those in the same industry. Our approach involves considering various factors that are vital in assessing the quality and reliability of dividend stocks:

11 key criteria we analyze when evaluating dividend stocks:

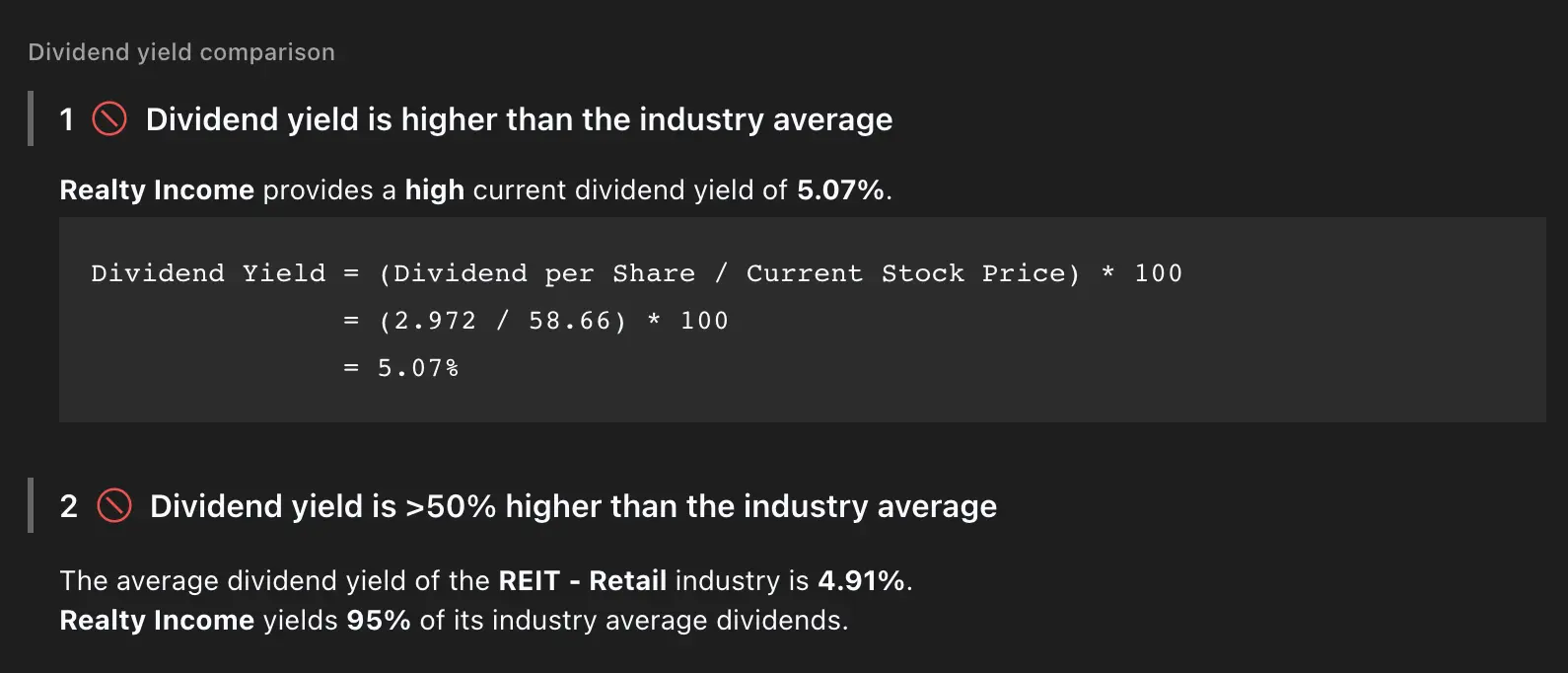

- Criterion 1: Dividend yield is higher than the industry average

- Criterion 2: Dividend yield is 50% higher than the industry average

- Criterion 3: Dividends are well covered by the earnings

- Criterion 4: Dividends are well covered by the cash flow

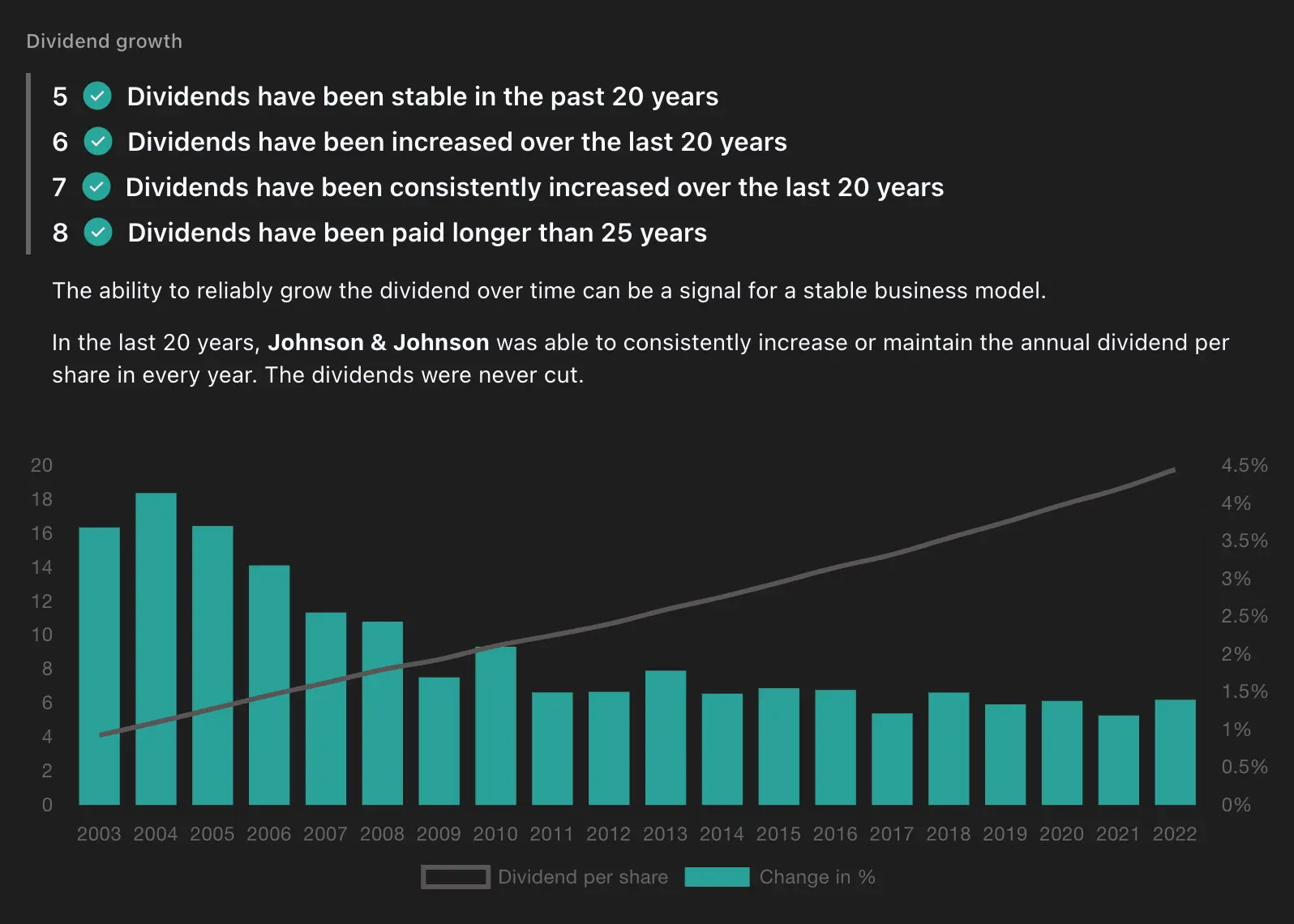

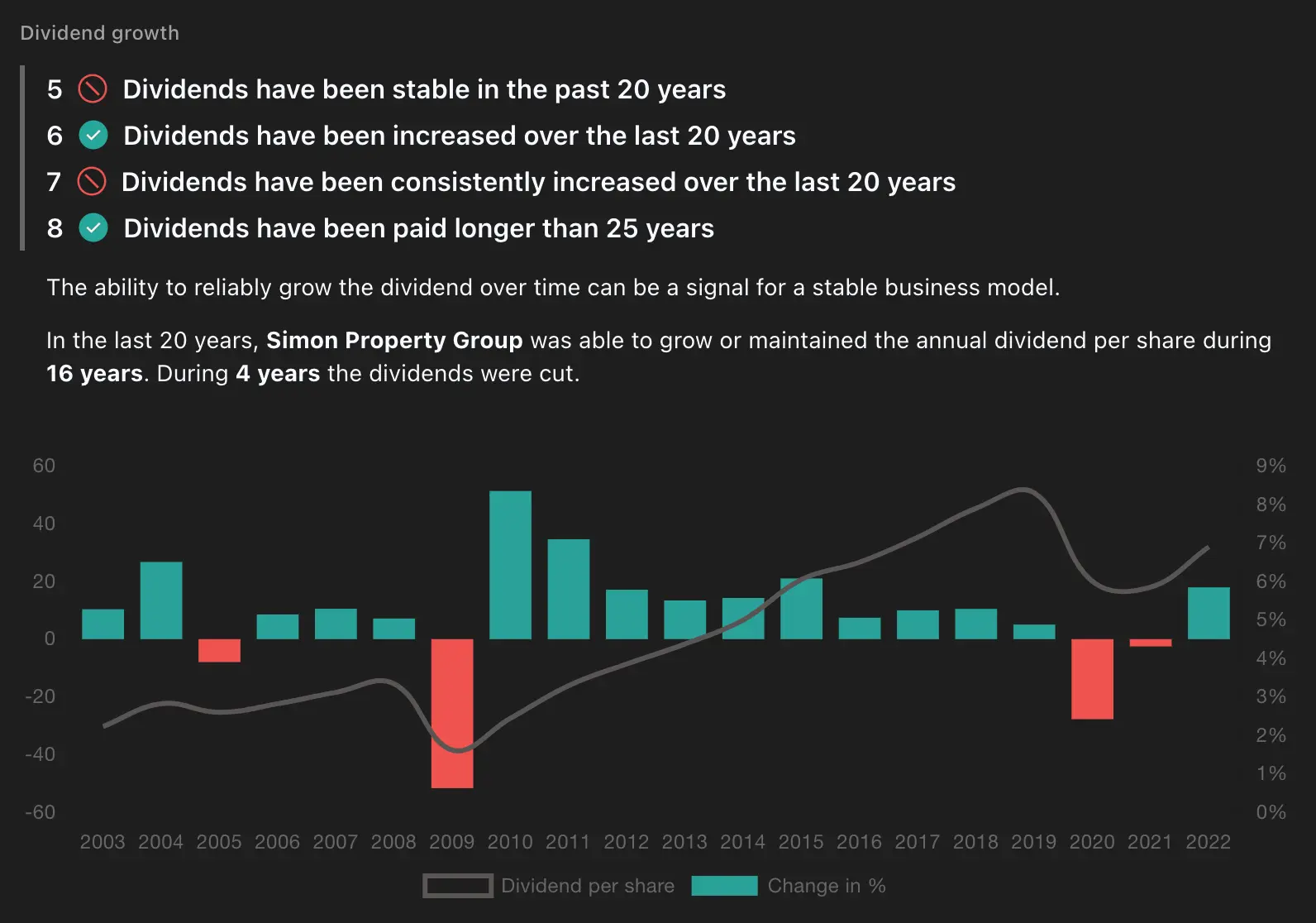

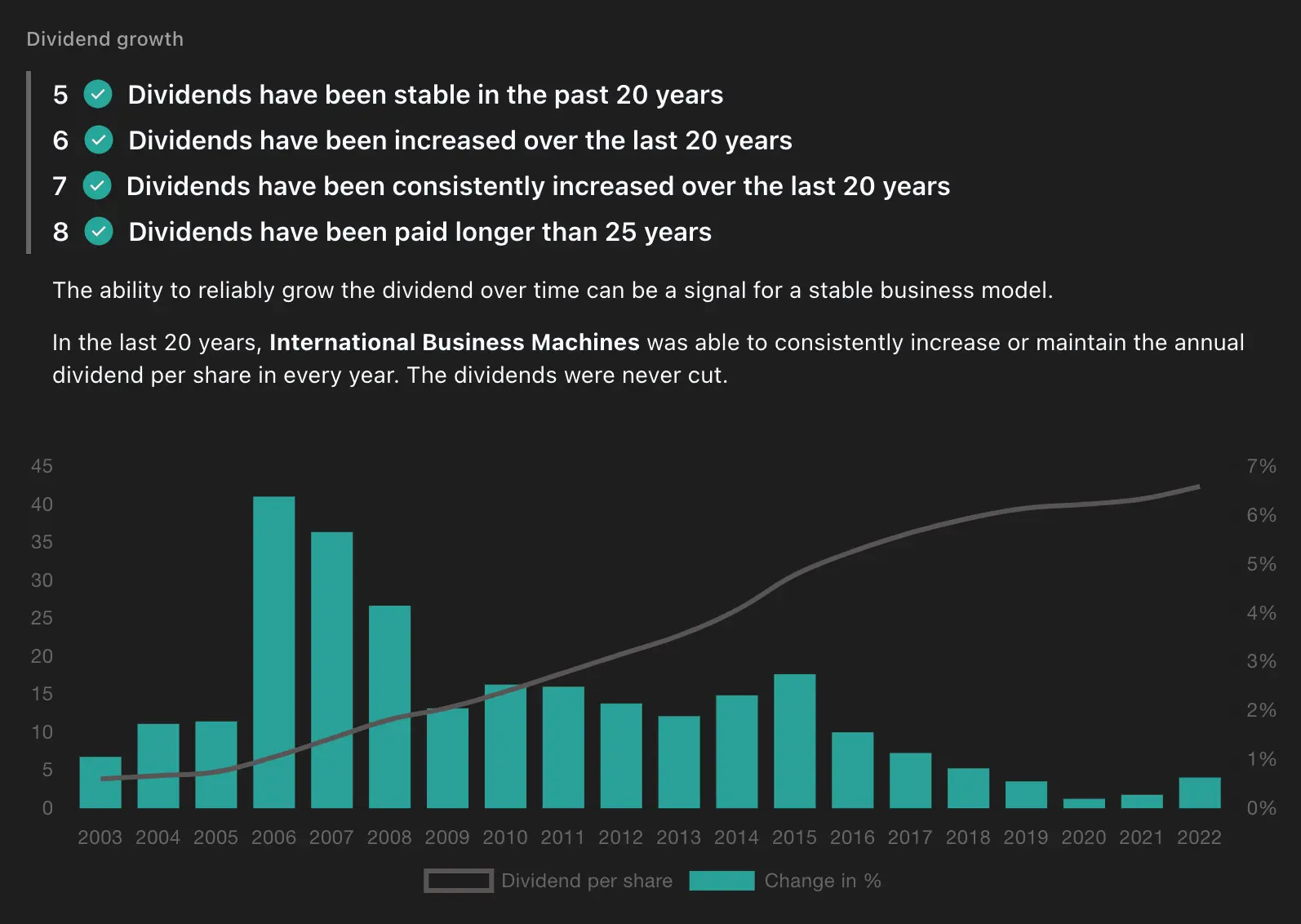

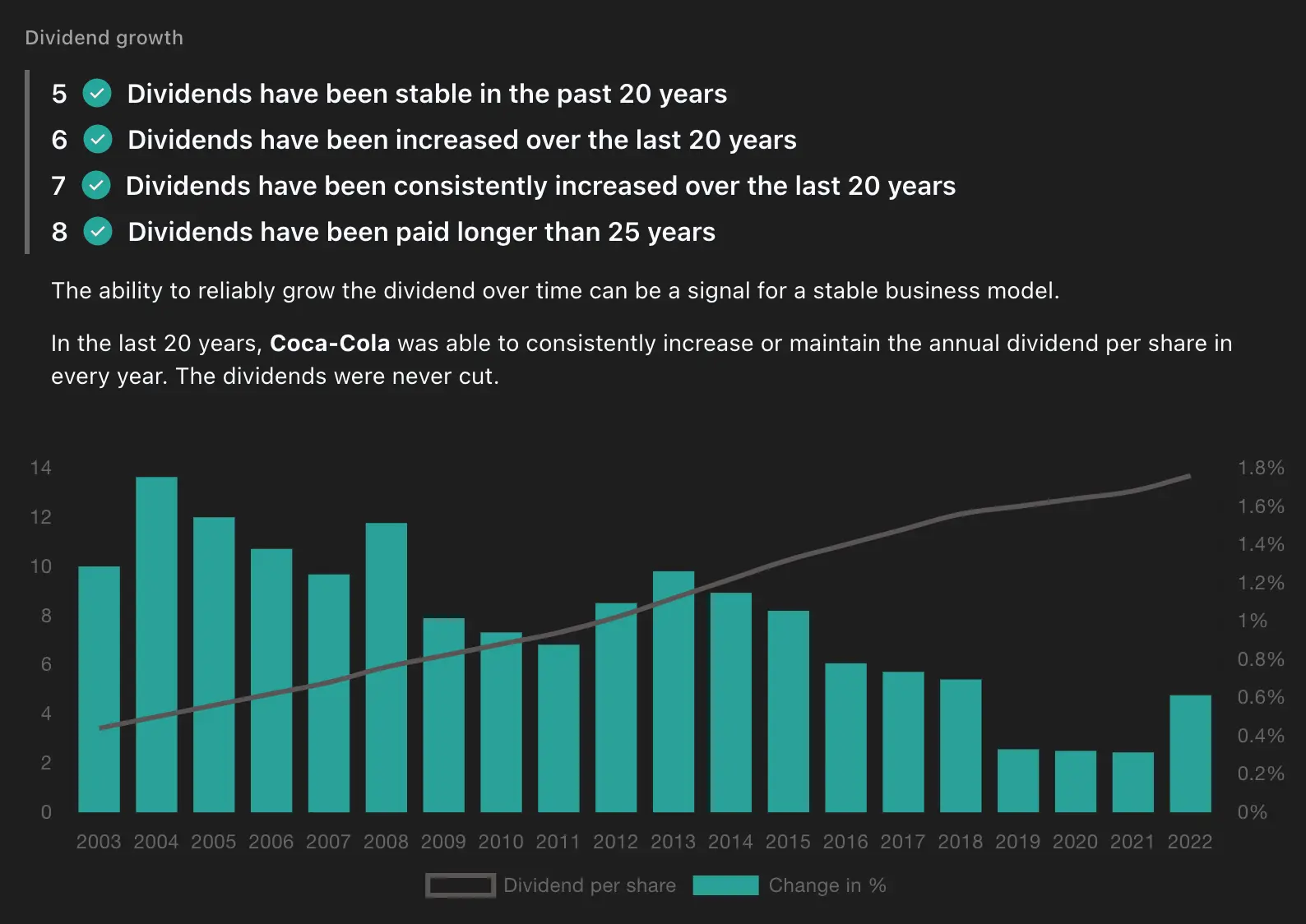

- Criterion 5: Dividends have been stable in the past 20 years (Weighted factor: 2)

- Criterion 6: Dividends have been increased over the last 20 years

- Criterion 7: Dividends have been constantly increased over the last 20 years (Factor: 2)

- Criterion 8: Dividends have been paid longer than 25 years

- Criterion 9: Stocks were repurchased last year

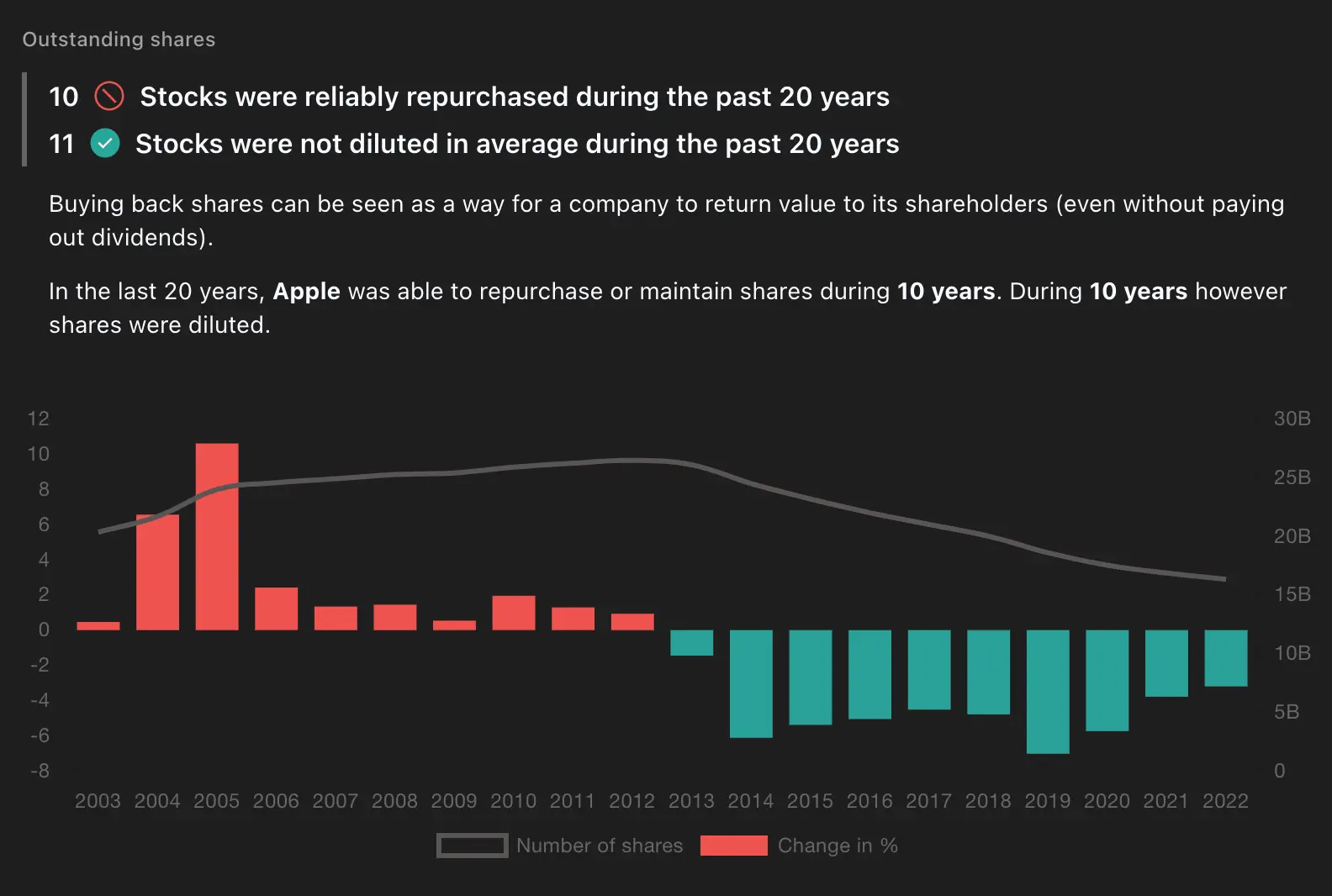

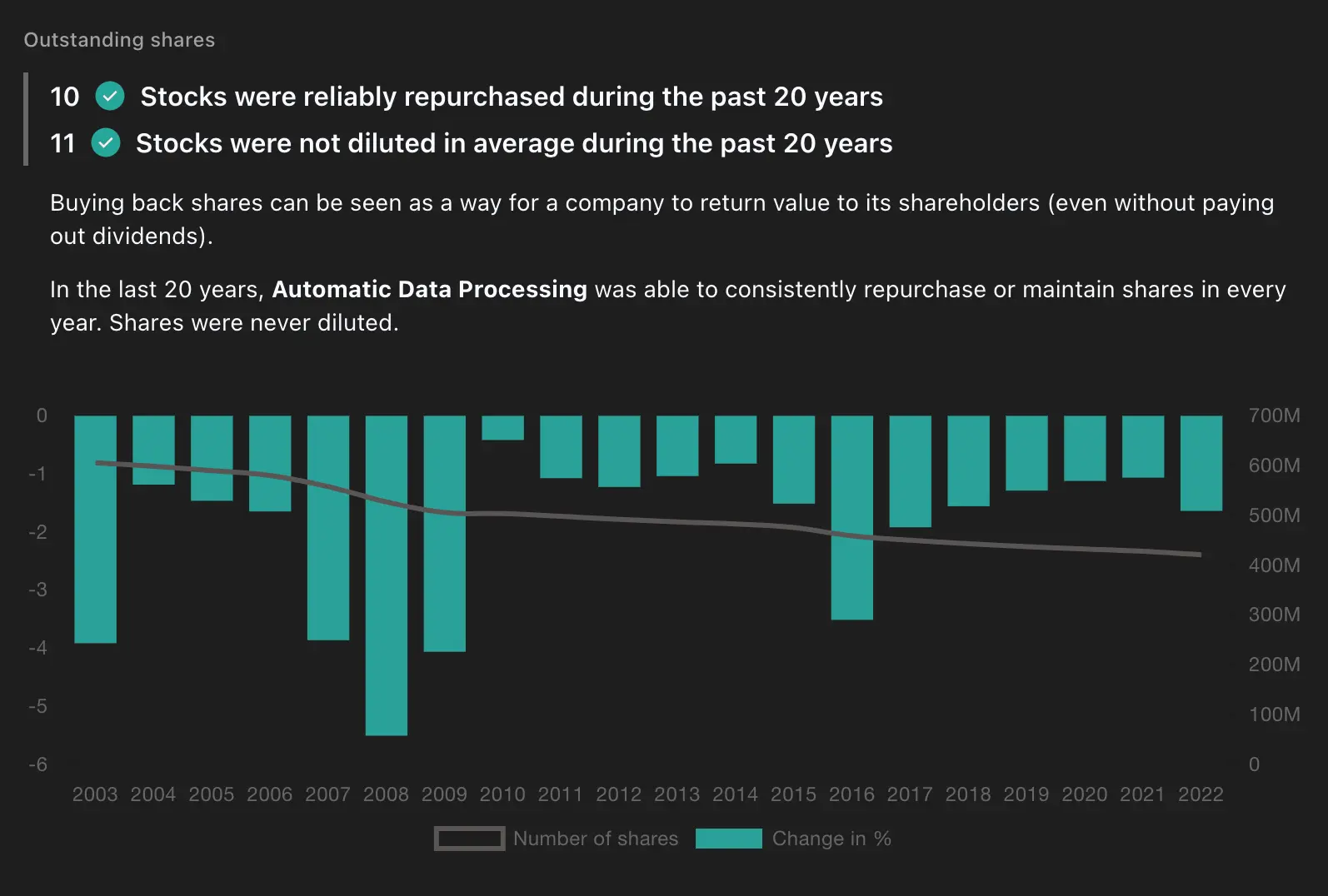

- Criterion 10: Stocks were reliably repurchased during the past 20 years

- Criterion 11: Stocks were not diluted on average during the past 20 years (Factor: 2)

We assign a factor of 2 to three specific criteria, 5, 7, and 11 - indicating their increased importance in our evaluation process. This weighting ensures that stability of dividends (criterion 5), consistent dividend increases (criterion 7), and absence of share dilution (criterion 11) are given additional significance when determining the suitability of a dividend stock.

By examining each of these criteria, we can provide you with a holistic assessment of a dividend stock's potential. Our aim also is to provide clear transparency and reasoning behind our evaluations, ensuring you can trust our assessments and make informed investment decisions based on them.

In the following sections, we will delve into each criterion, explaining why it is relevant and how it contributes to the overall assessment of dividend stocks.

Criterion 1: Dividend Yield Higher Than the Industry Average

First, let's compare a company's dividend yield (which is the ratio between the dividend per share and its current stock price) to its industry peers:

If a company has a higher dividend yield than the average of its industry, it indicates that the return on investment you receive for each dollar you invest in this company is higher than if you were to invest in its direct competitors, which could make it a more attractive investment for income-seeking investors:

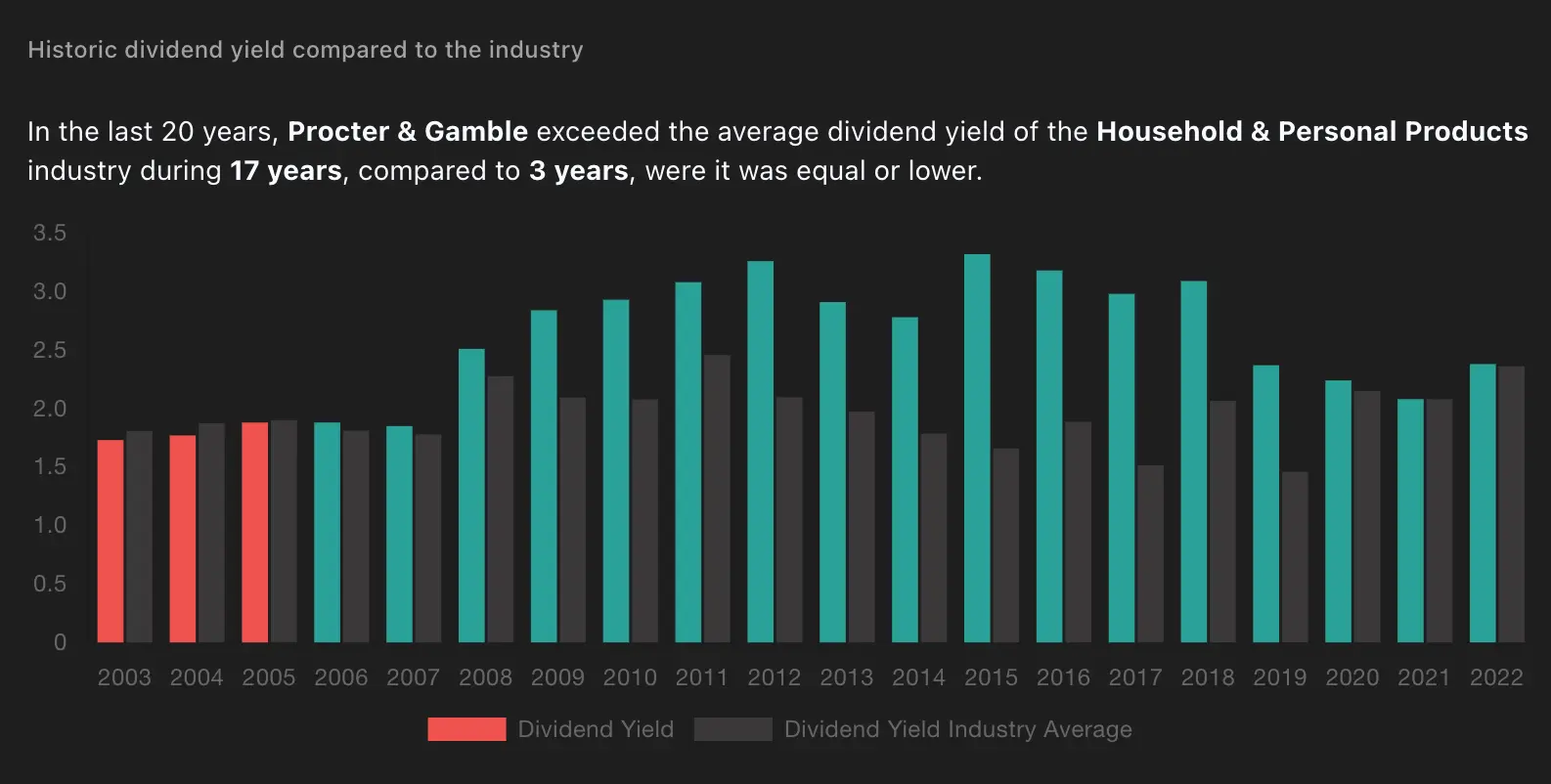

Criterion 2: Dividend Yield 50% Higher Than the Industry Average

A dividend yield that is significantly (≥ 50%) higher than the industry average can signal an attractive investment opportunity, but only if the company can afford it on a regular and long-term basis. Therefore we show the dividend yield compared to the industry for the last 20 years:

In this calculation, we are using the median as industry dividend yield average, since this distribution could contain extreme values that could significantly impact the average. Using median provides a more robust measure that is less influenced by outliers.

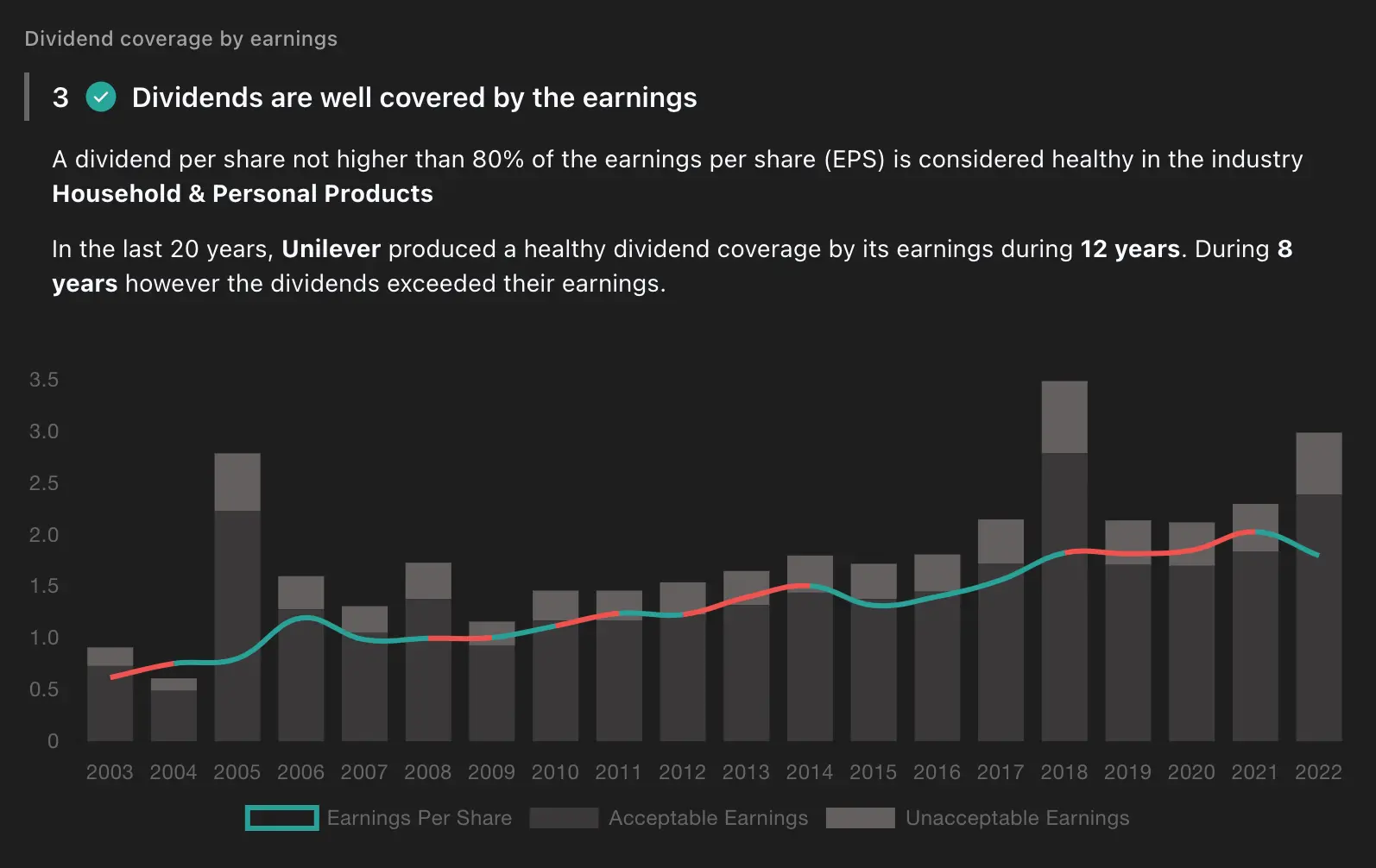

Criterion 3: Dividends Well Covered by Earnings

One crucial aspect to consider is whether the company's earnings sufficiently cover the dividends being paid. If the earnings comfortably exceed the dividend payments, it suggests that the company has a stable financial position and is capable of sustaining its dividend payouts.

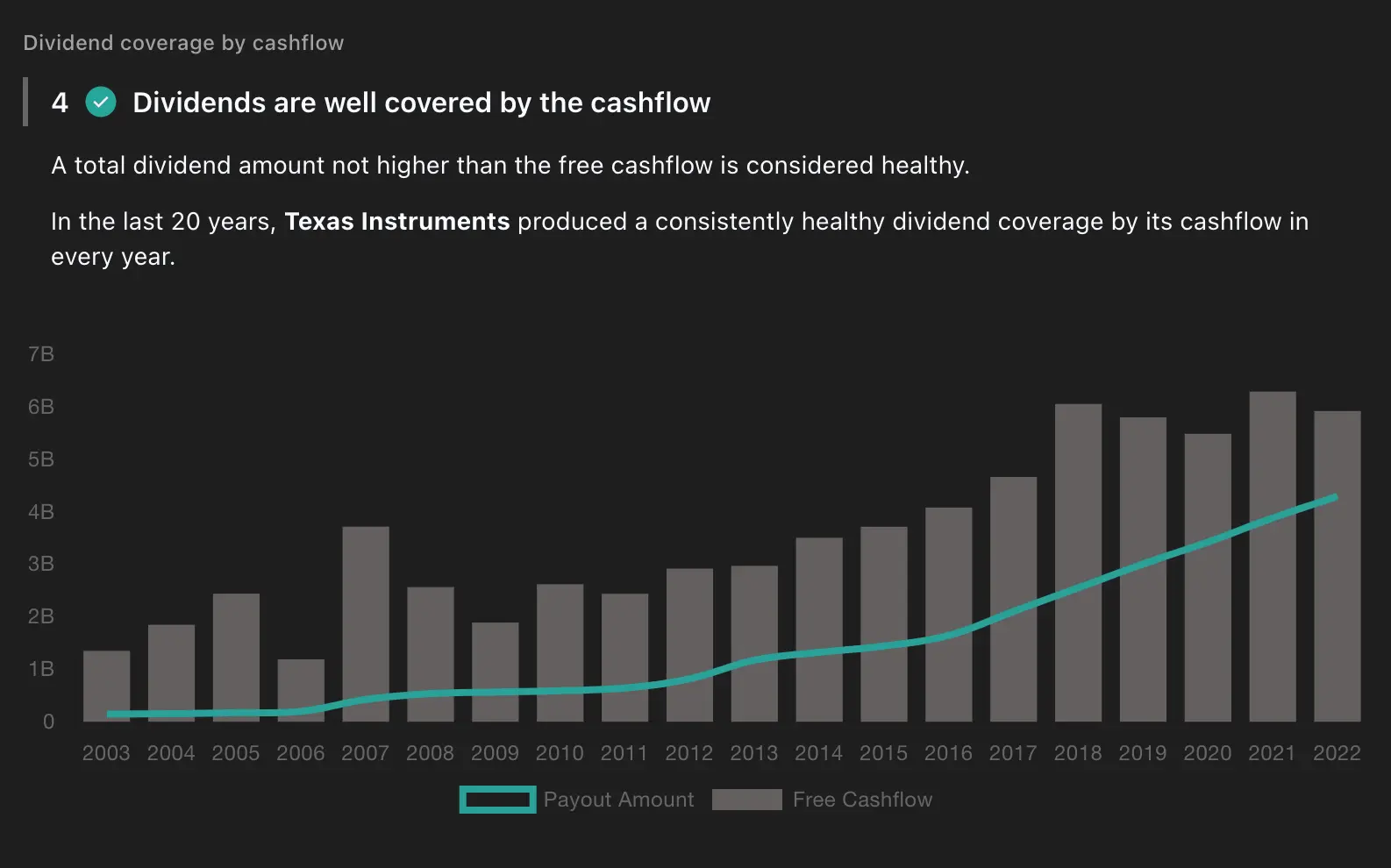

Criterion 4: Dividends Well Covered by Cash Flow

In addition to earnings, assessing the cash flow of a company is vital. If the cash flow consistently supports dividend payments, it indicates that the company has sufficient liquid resources to sustain and potentially increase its dividends over time.

Criterion 5: Stable Dividends Over the Past 20 Years

Stability in dividend payments, where the dividend per share did not drop by more than 20% over the past two decades, is of utmost importance for income-seeking investors. To emphasize the significance of stability, we have multiplied this criterion by a factor of 2 in our assessment. By considering historical data, spanning a substantial timeframe, we gain valuable insights into a company's track record of maintaining consistent dividend payouts. This long-term perspective enables investors to evaluate the company's resilience across various market cycles and economic conditions. A company that demonstrates a robust history of stable dividends provides income-seeking investors with increased confidence, enhanced financial planning, and a stronger potential for consistent income in the future.

Criterion 6: Dividends Increased Over the Last 20 Years

Generally, dividend growth is often a positive indicator of a company's financial health and its commitment to rewarding shareholders. In this simple test, we evaluated whether the dividends currently provided by a company are generally higher than they were 20 years ago.

Criterion 7: Constant Increase in Dividends Over the Last 20 Years

While general dividend growth is important, companies that have shown a constant increase in dividends over the past 20 years, are particularly noteworthy. This trend is a critical criterion for dividend investors, and we assign it double weight in our analysis. Companies that have consistently raised their dividends demonstrate a strong dividend policy and a steadfast commitment to regularly increasing payouts to shareholders.

Criterion 8: Dividends Paid for Over 25 Years

Companies that have paid dividends for an extended period, such as over 25 years, are called Dividend Aristocrats and have demonstrated their ability to generate stable earnings and reward shareholders consistently. Such stocks often come from established and resilient companies with a strong moat and herewith solid business model and pricing power.

Criterion 9: Stocks Repurchased Last Year

Stock buybacks can be a positive sign for investors, as they indicate that the company believes its shares are undervalued. Repurchasing stocks can lead to increased earnings per share and potentially enhance future dividend payments. In this simple test, we just look at the last year and test whether stocks were repurchased.

Criterion 10: Reliable Stock Repurchases Over the Past 20 Years

Stability in stock repurchases is another factor to consider. Companies that have reliably repurchased their shares over the past two decades demonstrate their commitment to returning value to shareholders and potentially improving long-term returns.

Criterion 11: Stocks Not Diluted on Average Over the Past 20 Years

Assessing whether a company has consistently diluted its shares over the past 20 years is crucial. A lack of share dilution suggests that the company has managed its capital structure effectively and has not significantly diminished the value of existing shares. Dilution can be seen as a form of creeping expropriation, so we assign it double weight in our analysis. When a company dilutes its shares, it effectively reduces the ownership percentage of existing shareholders, thereby eroding their proportionate stake in the company's earnings and assets. This can negatively impact the income potential and long-term value of an investment. By closely monitoring share dilution, investors can identify companies that prioritize preserving shareholder value.

Conclusion

In conclusion, with our streamlined process that condenses eleven steps into a single click, you can efficiently evaluate dividend stocks and enhance your ability to uncover high-quality investments. Keep in mind that thorough analysis of dividend yield, earnings and cash flow coverage, dividend stability, growth history, stock buybacks, and share dilution is crucial in identifying the best dividend stocks. By integrating these steps into your investment strategy, you can construct a portfolio that provides a dependable and expanding income stream for the future. Embark on your path towards financial success by delving into the realm of dividend stocks today!

Start on your path to financial success by exploring the world of stocks on marketstorylabs.com - simple, proficient, and free.

Obligatory risk notice

We would like to point out that the contents of this website are for general information purposes only and do not constitute recommendations for the purchase or sale of specific financial instruments, and therefore do not constitute investment advice. In particular, marketstorylabs.com and its creators cannot assess the extent to which information / recommendations made on the pages correspond to your investment objectives, your risk tolerance and your ability to bear losses. Therefore, if you make any investment decisions based on information on the site, you do so solely on your own responsibility and at your own risk. This in turn means that neither marketstorylabs.com nor its creators are liable for any losses incurred as a result of investment decisions based on the information on the marketstorylabs.com website or other media used.